Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Fiscal policy, measures employed by governments to stabilize the economy, specifically by manipulating the levels and allocations of taxes and government expenditures. Fiscal measures are frequently used in tandem with monetary policy to achieve certain goals.

READ MORE ON THIS TOPICFrance: Frankish fiscal lawThe Frankish fiscal system reflected the evolution of the economy. Frankish kings were unable to continue the Roman system of direct taxation…

The usual goals of both fiscal and monetary policy are to achieve or maintain full employment, to achieve or maintain a high rate of economic growth, and to stabilize prices and wages. The establishment of these ends as proper goals of governmental economic policy and the development of tools with which to achieve them are products of the 20th century.

In taxes and expenditures, fiscal policy has for its field of action matters that are within government’s immediate control. The consequences of such actions are generally predictable: a decrease in personal taxation, for example, will lead to an increase in consumption, which will in turn have a stimulating effect on the economy. Similarly, a reduction in the tax burden on the corporate sector will stimulate investment. Steps taken to increase government spending by public works have a similar expansionary effect. Conversely, a reduction in government expenditure or an increase in tax revenues, without compensatory action, has the effect of contracting the economy.

Fiscal policy relates to decisions that determine whether a government will spend more or less than it receives. Until Great Britain’s unemployment crisis of the 1920s and the Great Depression of the 1930s, it was generally held that the appropriate fiscal policy for the government was to maintain a balanced budget. The severity of these disturbances gave rise to a new set of ideas, first given formal treatment by the economist John Maynard Keynes, revolving around the notion that fiscal policy should be used “countercyclically,” that is, that the government should exercise its economic influence to offset the cycle of expansion and contraction in the economy. Keynes’s rule, briefly, was that the budget should be in deficit when the economy was experiencing low levels of activity and in surplus when boom conditions (often accompanied by high inflation) were in force.Get exclusive access to content from our 1768 First Edition with your subscription.Subscribe today

Under the balanced-budget regime, personal and business tax rates were raised during periods of declining economic activity to ensure that government revenues were not reduced. The effect of this was to reduce consumption still further, increase surplus industrial capacity, and depress investment, all of which exerted a downward pressure on the economy. Alternatively, if, in order to maintain a balanced budget, taxes remained level but government expenditures were cut back during such a period of declining economic activity, a similar downward pressure was exerted. The Keynesian theory showed that, under certain conditions, the operation of market forces would not automatically generate full employment, and that governments should abandon the balanced-budget concept and adopt active measures to stimulate the economy. Furthermore, to be really effective, these measures should be financed by government borrowing rather than by raising taxes or by cutting other government expenditures. Initial experiments with this new stabilizing technique in the United States during the first term (1933–37) of President Franklin D. Roosevelt’sadministration were somewhat disappointing, partly because the amount of deficit financing was not large enough and partly, perhaps, because the expectations of business had been dulled to such an extent by the Great Depression that it was slow to respond to opportunities. With the advent of World War II and soaring government spending, the unemployment problem in the United States virtually disappeared.

In the postwar period the use of fiscal policy changed somewhat. The problem was no longer massive unemployment but a persistent tendency to inflation against a backdrop of fairly rapid economic growth punctuated by short periods of shallow recession.

Since the days of Keynes, fiscal policy has been refined to smooth these cyclical movements. As a counter inflationary tool it has not been particularly effective, partly because of political constraints and partly because of the so-called automatic stabilizers at work. The political constraints arise from the fact that politicians have found it unpopular to raise taxes and cut government expenditure when the economy becomes overheated. The automatic stabilizers in the economy inhibited the use of discretionary fiscal policy. For example, during a recession personal incomes will be shrinking, but, owing to the highly progressive tax system (i.e., tax rates that rise disproportionately on higher incomes), the loss of purchasing power of the consumers is cushioned, leaving more spending money in the hands of the consumers than would otherwise have been the case. This will be accompanied by a decline in government tax revenues, and, so long as the government does not take steps to reduce expenditures to compensate for the loss of revenue, the net result will be to temper the decline in the level of economic activity. Conversely, during a boom a disproportionate share of the additional income flows into the treasury, keeping the rate of consumption expenditures below the rate that might have otherwise prevailed in the absence of a progressive tax system. Unemployment benefits produce a similar effect. During a recession unemployment benefits rise with the growing numbers of unemployed and prevent disposable incomes from falling by as much as would otherwise have been the case. This situation normally causes an increase in government expenditures and a decrease in tax revenue. When the economy begins to expand again and demand for labour picks up, the unemployment pay drops automatically, tax revenue increases, and expenditures decrease.

For more materials visit: University of Nigeria Nsukka

Monetary policy is an economic policy that manages the size and growth rate of the money supply in an economy. It is a powerful tool to regulate macroeconomic variables such as inflation and unemployment.

These policies are implemented through different tools, including the adjustment of the interest rates, purchase or sale of government securities, and changing the amount of cash circulating in the economy. The central bank or a similar regulatory organization is responsible for formulating these policies.

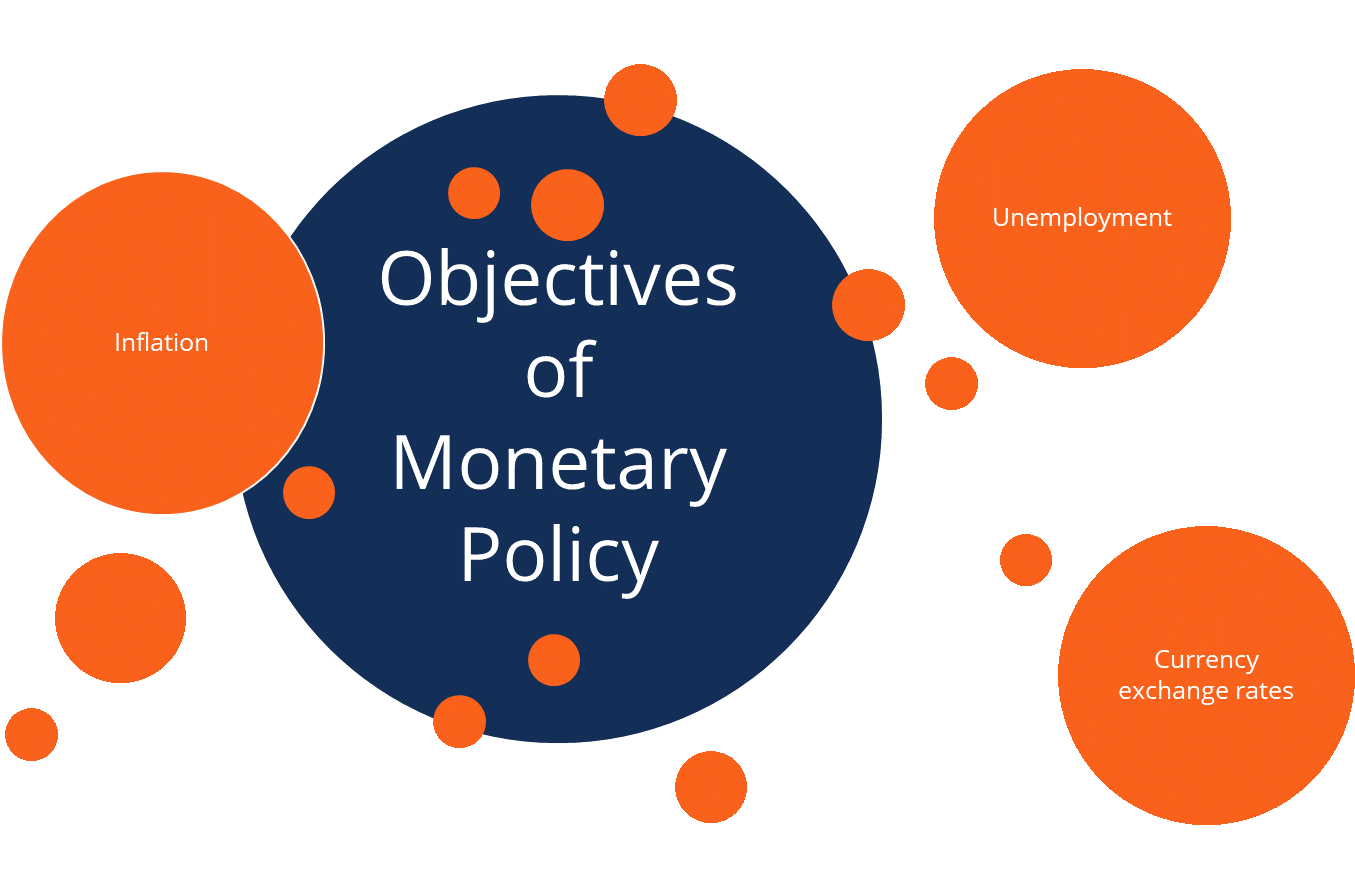

The primary objectives of monetary policies are the management of inflation or unemployment, and maintenance of currency exchange rates.

Monetary policies can target inflation levels. A low level of inflation is considered to be healthy for the economy. If inflation is high, a contractionary policy can address this issue.

Monetary policies can influence the level of unemployment in the economy. For example, an expansionary monetary policy generally decreases unemployment because the higher money supply stimulates business activities that lead to the expansion of the job market.

Using its fiscal authority, a central bank can regulate the exchange rates between domestic and foreign currencies. For example, the central bank may increase the money supply by issuing more currency. In such a case, the domestic currency becomes cheaper relative to its foreign counterparts.

Central banks use various tools to implement monetary policies. The widely utilized policy tools include:

A central bank can influence interest rates by changing the discount rate. The discount rate (base rate) is an interest rate charged by a central bank to banks for short-term loans. For example, if a central bank increases the discount rate, the cost of borrowing for the banks increases. Subsequently, the banks will increase the interest rate they charge their customers. Thus, the cost of borrowing in the economy will increase, and the money supply will decrease.

Central banks usually set up the minimum amount of reserves that must be held by a commercial bank. By changing the required amount, the central bank can influence the money supply in the economy. If monetary authorities increase the required reserve amount, commercial banks find less money available to lend to their clients and thus, money supply decreases.

Commercial banks can’t use the reserves to make loans or fund investments into new businesses. Since it constitutes a lost opportunity for the commercial banks, central banks pay them interest on the reserves. The interest is known as IOR or IORR (interest on reserves or interest on required reserves).

The central bank can either purchase or sell securities issued by the government to affect the money supply. For example, central banks can purchase government bonds. As a result, banks will obtain more money to increase the lending and money supply in the economy.

Depending on its objectives, monetary policies can be expansionary or contractionary.

This is a monetary policy that aims to increase the money supply in the economy by decreasing interest rates, purchasing government securities by central banks, and lowering the reserve requirements for banks. An expansionary policy lowers unemployment and stimulates business activities and consumer spending. The overall goal of the expansionary monetary policy is to fuel economic growth. However, it can also possibly lead to higher inflation.

The goal of a contractionary monetary policy is to decrease the money supply in the economy. It can be achieved by raising interest rates, selling government bonds, and increasing the reserve requirements for banks. The contractionary policy is utilized when the government wants to control inflation levels.

For more materials visit: University of Nigeria Nsukka

This is an example post, originally published as part of Blogging University. Enroll in one of our ten programs, and start your blog right.

You’re going to publish a post today. Don’t worry about how your blog looks. Don’t worry if you haven’t given it a name yet, or you’re feeling overwhelmed. Just click the “New Post” button, and tell us why you’re here.

Why do this?

The post can be short or long, a personal intro to your life or a bloggy mission statement, a manifesto for the future or a simple outline of your the types of things you hope to publish.

To help you get started, here are a few questions:

You’re not locked into any of this; one of the wonderful things about blogs is how they constantly evolve as we learn, grow, and interact with one another — but it’s good to know where and why you started, and articulating your goals may just give you a few other post ideas.

Can’t think how to get started? Just write the first thing that pops into your head. Anne Lamott, author of a book on writing we love, says that you need to give yourself permission to write a “crappy first draft”. Anne makes a great point — just start writing, and worry about editing it later.

When you’re ready to publish, give your post three to five tags that describe your blog’s focus — writing, photography, fiction, parenting, food, cars, movies, sports, whatever. These tags will help others who care about your topics find you in the Reader. Make sure one of the tags is “zerotohero,” so other new bloggers can find you, too.